(course) International Merchandise Trade Statistics (IMTS) 28/02/2022

Table of Contents

Agenda of the course 2022

Dates/Description

28 February - 4 March: Module 1 - Conceptual Framework

7-11 March: Module 2 - Institutional Arrangements

14-18 March: Module 3 - Production and Compilation

21-25 March: Module 4 - Metadata and Data Quality

28 March - 1 April: Module 5 - Dissemination and Analysis

4-8 April: Module 6 - New Areas of Work

12 April: 2 webinars (90") on Tuesday 12 April:

- at 9 AM CEST and

- at 3 PM CEST.

The recommended reading material: International Merchandise Trade Statistics: Compilers Manual, Revision 1 (IMTS 2010-CM)

Module 1 - Conceptual Framework

Participants Manual Module 1

3. SCOPE AND TIME OF RECORDING

- As a general guideline, record all goods which add to or subtract from the stock of material resources of a country by entering (imports) or leaving (exports) its economic territory (para. 1.2).

- Trade below customs and statistical thresholds: Estimate and include if economically significant (para. 1.3)

- Change of ownership: Use as criteria for recording of certain goods only in exceptional cases when the general guideline is not applicable or not sufficient (para. 1.4).

- Time of recording: As a general guideline, record goods at the time when they enter or leave the economic territory of a country (para. 1.8). In the case of customs-based data collection systems, this time can be frequently approximated by the date of lodgement of the customs declaration (para. 2.22).

- For IMTS 2010 purposes, any installation or equipment, mobile or not, located outside the geographical territory of a country, owned by the country resident(s) and remaining under the country’s jurisdiction, is treated as if it were a part of its economic territory. This applies, for example, to drilling rigs, ships, aircraft, space stations, etc.

Optional Non-evaluated Module 1 Quiz

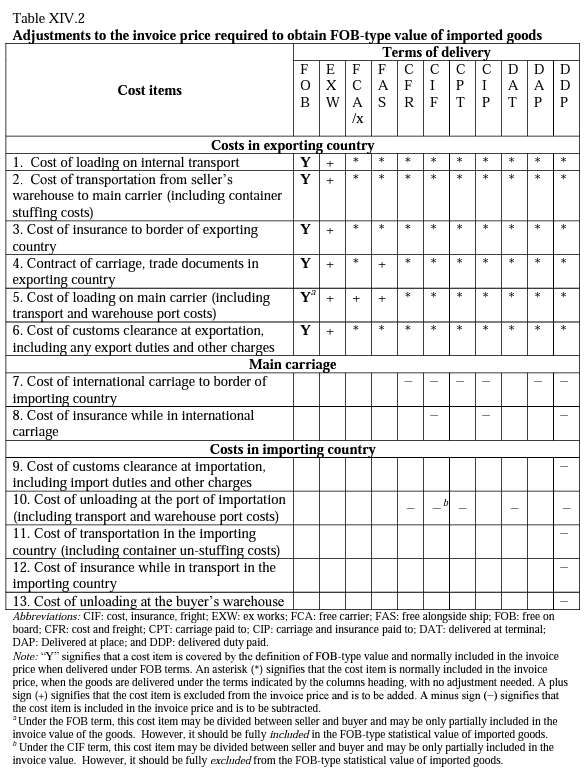

What is the CIF value for this import transaction? A = place of dispatch; B = border of the importing Country; C = destination. Import with Terms of delivery DDU ‘C’ (invoiced amount includes freight costs from the place of dispatch to the destination). Invoiced amount for two items: Invoiced value of item 1 (100 kg) is $1,500. Invoiced value of item 2 (50 kg) is $2,240. Total: $3,740. Total Freight costs from the border of the importing country to the destination are assumed to be $300.

The correct answer is: Item 2: $2,140. CIF counting: A to C. The rule to split the freight is the weight principle as standard freight pricing is based on weight rather than value.

What is the FOB value for this export transaction? A = place of dispatch; B = border of the exporting country; C = destination. Export with Terms of delivery DDU ‘C’ (invoiced amount includes freight costs from the place of dispatch to the destination). Total invoiced amount: $5,600. Calculated freight costs from the border of the exporting Country to C: $1,200.

The correct answer is: $4,400

What is the FOB value for this export transaction? A = place of dispatch; B = border of the exporting country; C = border of the importing country; D = place of destination. Exports with EXW (ex-works, 工厂交货价) delivery terms (the invoiced amount excludes transport costs from the place of dispatch to the place of destination). Transport costs are proportional to the distance). Total amount billed: $5,600. Transportation costs from A to D: $2,000. Total distance = 2,000 km (distance A->B = 250 km, distance B->C = 1,000 km and distance C->D = 750 km).

The correct answer is: $5,850For FOB, Only A to C counts. 5600+2000*(250/2000)

What is the CIF value for this import transaction? To = place of shipment; B = border of the exporting country; C = border of the importing country; D = place of destination. Imports with delivery conditions DDP (Delivered to the final place of destination including Duty Paid) (the invoiced amount includes the transport costs from the place of dispatch to the place of destination). Transport costs are proportional to the distance. Total amount billed: $5,200. Transportation costs from A to D: $2,000. Total distance = 2,000 km (distance A->B = 250 km, distance B->C = 1,000 km and distance C->D = 750 km).

The correct answer is: $4,450. For CIF, Only A to C counts. 5200-2000*(750/2000)

A satellite is produced and launched in country B. The owner of the satellite is in country A. What is the appropriate treatment in trade statistics of country A?

The correct answer is: import with value limited to the satellite (excluding the launcher)

All goods which add to or subtract from the stock of material resources of a country by entering (imports) or leaving (exports) its economic territory (para. 1.2). Change of ownership: Use as criteria for recording of certain goods only in exceptional cases when the general guideline is not applicable or not sufficient.What is the CIF value for this import transaction? A = place of dispatch; B = border of the exporting country; C = border of importing country; D =destination. Import with Terms of delivery EXW ‘A’ (invoiced amount excludes freight costs from the place of dispatch to the destination). Total invoiced amount: $3,200. Commission costs = $240. Freight costs from A to D: $2,000. Total distance = 2,000 km (distance A->B = 500 km, distance B->C = 1,000 km and distance C->D = 500 km).

The correct answer is: 4,940 The commission costs are counted within CIF.

Module 3 - Production and Compilation

- Use of customs records: Use customs records as the main and normally

preferred data source (para. 8.2). New recommendation

Information available at customs is not limited to the customs declaration since supportive documentation, such as the commercial invoice, transport documents, import licenses and certificate of origin, usually accompanies the customs declaration. Compilers should make arrangements with customs authorities to have access to these documents, as required (e.g., to solve gaps and quality concerns) and as permitted by law and to use them as additional sources of information.